The Facts About Lamina Loans Uncovered

The Best Strategy To Use For Lamina Loans

Table of Contents4 Simple Techniques For Lamina LoansExamine This Report on Lamina LoansFascination About Lamina LoansThe Ultimate Guide To Lamina LoansThe Ultimate Guide To Lamina LoansUnknown Facts About Lamina LoansLamina Loans Can Be Fun For Everyone

Functioning to improve your credit rating is a wonderful action to take previously using for an individual financing. True, even if your debt health and wellness is reduced, there are subprime lending institutions out there who can give you the personal financing you need. As we said, your rate of interest price can finish up being incredibly high, costing you hundreds, also thousands of dollars additional.

If you're trying to find a low-interest individual lending in Canada, there are a couple of things you can do to obtain one. Lending rate of interest lendings can be obtained by doing one or more of the following: As formerly stated, security reduces the loan providers' borrowing risk. Therefore, they are a lot more happy to provide a low-interest funding when you supply a property as security.

The 8-Second Trick For Lamina Loans

You can get a low-interest financing in Canada, if you get a cosigner for your loan. Your credit score can greatly affect the passion rate you obtain on your car loan.

It's called a "guarantor finance" as well as involves locating a cosigner before applying. Your own negative credit rating will certainly no more be a problem during the application process. Rather, your authorization will depend upon your cosigner's credit report health. Preferably, your cosigner would certainly require to have good credit history as well as a good income - Lamina Loans.

Yes, there are numerous alternative lending institutions in Canada that provide personal finances with no credit scores checks. In place of your credit history rating, they will certainly evaluate your earnings degree, employment stability, debt-to-income ratio and other economic elements that will certainly identify your creditworthiness. When requesting a personal lending you'll need to offer certain documents for confirmation and also identification functions.

Not known Incorrect Statements About Lamina Loans

The rate you're charged depends on your lender, your credit history, your debt-to-income ratio, and also your loan terms. Typically, rate of interest vary anywhere between 15% and 45% for an individual funding. However, the federal government placed a criminal passion rate cap on the price loan providers can charge for personal financings.

Click the switch below to fill in an application to see what your options are.

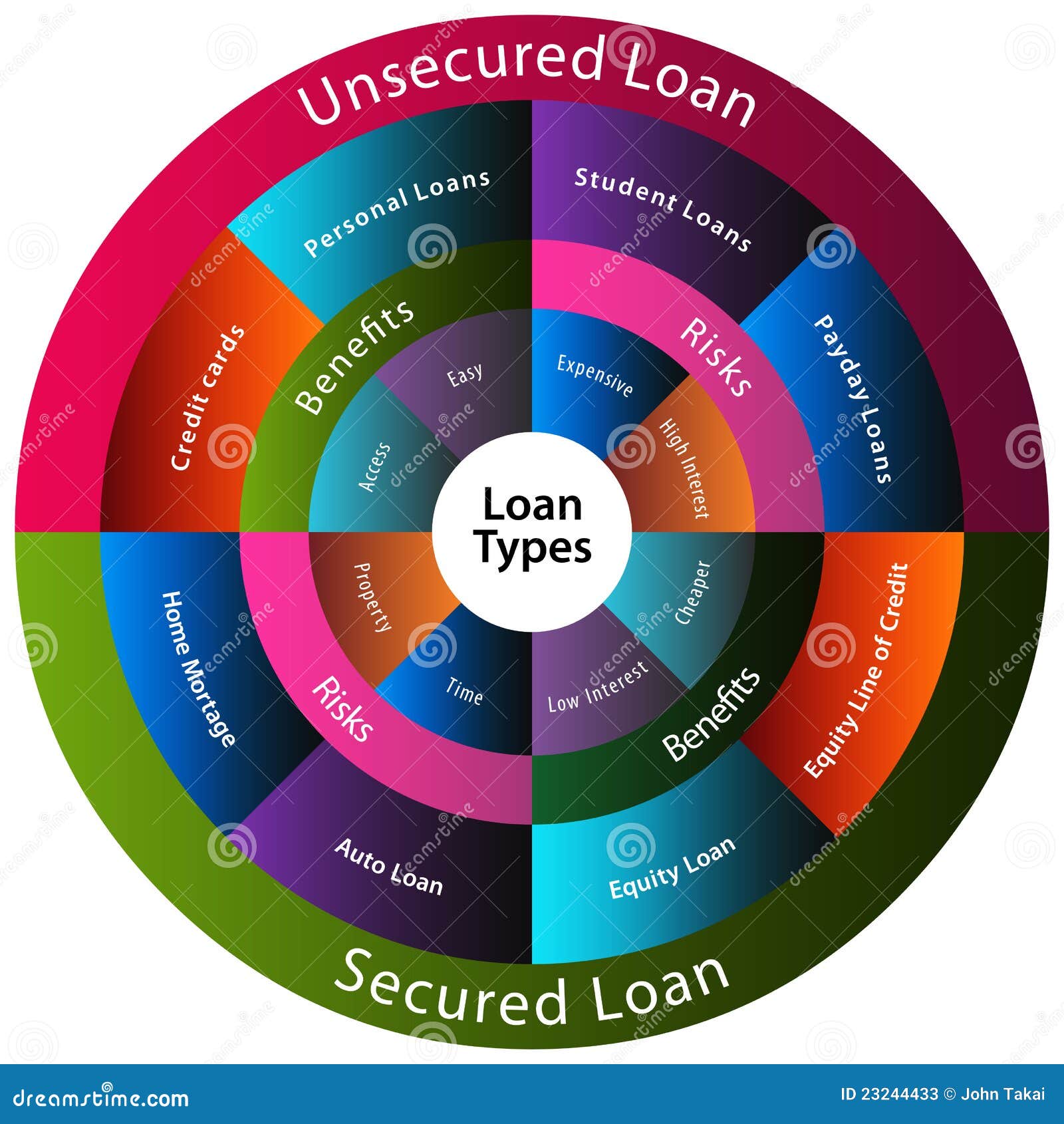

Unprotected ways that you're obtaining money without placing anything up as collateral to "safeguard" the financing. These car loans normally require a greater credit rating score to confirm your credit reliability.

The smart Trick of Lamina Loans That Nobody is Discussing

Some lenders may even allow you to set a sensible settlement amount based upon your revenue and also rate of interest rate. Yet compare individual financing lending institutions prior to you decide, so you can find the ideal terms for your scenario. You can normally take out a personal funding for whatever you require it for like home renovation or financial obligation combination.

The lower your rating, the less most likely you are to certify as well as if you do, the greater your rate of interest will certainly be. You'll require to show you can afford to pay the loan back. If you don't have a consistent work with a reputable revenue, you might not get approved for a loan.

Some Ideas on Lamina Loans You Need To Know

It's best for anybody with a good credit report that can prove they'll pay it back each month. Protected individual car loans are financings that require collateral like your house or automobile to "protect" or obtain the funding. If you fail on your financing, the lender can confiscate the home you installed as security.

Since you're using something as security, safeguarded car loans are simpler to get for people with reduced credit rating. Since there's security, the lending institution views you as a less high-risk borrower, so rates of interest often tend to be reduced on safe lendings If you don't make on-time payments, your security can next page obtain removed.

A safe loan is great for somebody who doesn't have an optimal credit rating for a lending yet requires one anyway. If you don't have a high credit history, think about a secured financing to confirm you can pay promptly on a monthly basis. A rotating line of credit rating offers you accessibility to money that you can obtain approximately your credit restriction.

Indicators on Lamina Loans You Need To Know

If you lug a balance, you most likely will have to pay passion on top of that amount - Lamina Loans. Revolving credit history comes in the type of bank card, a line of credit, or a residence equity credit line (HELOC). If you have actually got expenses that schedule, but don't make money for a few weeks, rotating credit report can aid you pay those expenses.

Numerous credit cards provide incentives for usage, like cash back, points, or various other incentives. This quantity can fluctuate based on just how you utilize your rotating credit scores.

If you have wonderful credit rating, you official source can get approved for a lower passion rate in instance you do bring a balance over from month to month. Installation lendings are loans that have a particular amount of payments as well as when you pay them back, your car loan is paid completely. This is the opposite of rotating credit score, where you can take money out as well as pay it back throughout a few months or years, depending on your contract.

6 Easy Facts About Lamina Loans Described

If your installment loan has a set rates of interest, your funding payment will certainly be the very same on a monthly basis. Your spending plan will not rise and also drop based upon your settlements, which is handy if you do not have a great deal of wiggle area for change. Installation car loans do not enable you to go back and take out much more in instance you need it.

Otherwise, you may need to get an Bonuses additional financing. Having a set amount you need to obtain and also repay makes installment financings excellent for someone that understands exactly just how much they require and also just how much they can afford. A set passion price is a price that doesn't transform over the life of the loan.